Getting My How Much Does The Average Real Estate Agent Make To Work

Some examples of business realty residential or commercial properties include workplace (workplace), restaurants (retail), and large apartment (multi-family). Industrial realty: As the name recommends, these properties serve a commercial business function. Some examples consist of shipping or storage warehouses, factories, and power plants. Land: Land typically includes undeveloped property with no structures on it.

Landowners can generate income through land use, such as farming, or upon the advancement or sale of the land. In addition to home types, there are three primary methods to earn money from realty financial investments: interest from loans, gratitude, and lease. Interest from Loans (or, in the parlance of realty, "financial obligation"): A genuine estate loan is an arrangement where investors lend money to a property developer and generate income from interest payments on the principal of the loan.

Depending on the variety of lending institutions, there can be one or several types of financial obligation within the capital stack of loans. Types of debt include senior financial obligation, junior debt, and mezzanine debt. Debt can also be secured or unsecured. This difference specifies a financier's rights in case of a residential or commercial property's foreclosure upon the default of a loan.

Interest payments may use a method to earn passive income from real estate investments. Gratitude: Just like the ownership of any equity, realty ownership provides a financier the ability to generate income from the sale of that equity. The appreciation, or increase in the value of a residential or commercial property gradually, represents the possible earnings available to a financier when that residential or commercial property is offered.

An Unbiased View of How To Find A Good Real Estate Agent

Equity can usually be categorized as preferred equity or common equity. Equity ownership can be an active or passive investment depending upon the position of the investment within the capital stack. Lease: A home can be rented by owners to earn income from rental payments. Similar to the earnings generated from a financial obligation investment, rental income can supply a regular earnings stream.

Rental payments might use the potential for passive income depending on the financial investment technique. Each classification of realty and kind of investment brings its own set of risks and rewards. Regardless of how you invest in real estate, it is essential to choose financial investments sensibly by checking the strengths and weaknesses of chances through a rigorous underwriting procedure.

Lots of financiers like to utilize the forecasted rate of return as a crucial metric when analyzing real estate (how to become a real estate agent in florida). Nevertheless, more skilled genuine estate investors will often rely on capitalization rate, or "cap rate," as a favored way to evaluate an opportunity. There are lots of methods to purchase realty with varying quantities of money, and varying degrees of time commitment, capital, investment horizons, risk, and return prospective.

Genuine estate investment methods fall under 2 groups: active and passive financial investments. Here are 8 basic methods to purchase property with methods varying from intense, high-effort to hands-off, low-effort. Active property investing demands significant individual understanding of property and hands-on management or delegation of duties. Active investors can work as genuine estate investors part-time or full-time, depending upon the number of their financial investment residential or commercial properties and the nature of those financial investments.

What Does How To Generate Real Estate Leads Do?

Because of this, active investor require a deep understanding of how to invest in realty, consisting of monetary acumen, and negotiation abilities to enhance their cap rate and total roi. House-flipping is the most active, hands-on way to buy real estate. In a house flip, an investor purchases a home, makes modifications and remodellings to enhance its worth in the market, and after that sells it at a higher rate.

This eats away at their return capacity when they offer it. Financiers can repair or remodel the house to increase its price or sell it without making any repair work when its worth in the real estate market increases due to outside factors. https://diigo.com/0j784j If you view HGTV, then you have actually probably seen a home get changed in under thirty minutes and cost a substantial revenue by house-flipping specialists.

While house-flipping is interesting, it also requires deep financial and property understanding to make sure that you can make over the home within time and budget restrictions to make sure that you earn money when the house is offered. The success and the monetary concern of a house flip falls entirely on the investor.

It's a high-pressure and high-stakes real estate investment that makes for great TV, but a good investment chance only for certain educated investors. Another property-flipping strategy is wholesaling. Wholesaling is when a financier signs an agreement to purchase a residential or commercial property that they believe is priced below market value and then offers that contract quickly to another financier at a higher price for an earnings.

Our Who Pays The Real Estate Agent Diaries

A financier will sign a contract to buy a property and put down an down payment deposit. Then, they quickly attempt to offer the home to a house-flipper at a premium, earning a profit. Basically, a wholesaler gets a finder's cost for brokering a home sale to a house-flipper (what is redlining in real estate). However, unlike traditional home brokers, a wholesaler uses their position as the contracted property buyer to broker the deal.

It demands sound due diligence and access to a network of potential purchasers in order to sell the property within a short timeframe at a rewarding price. Otherwise, like house-flipping, you run the risk of not earning an earnings or, worse, losing money. Rental residential or commercial properties require hands-on management, too, but they have a long-lasting financial investment horizon.

Homeowner make regular money circulation generally on a monthly basis in the type of rental payments from renters. This can provide a stable, trusted earnings stream for st john timeshares for sale investors, however it likewise needs a great deal of work or delegation of duties to ensure that operations run smoothly. First, you must discover occupants for your home.

You are likewise accountable for performing background screenings for potential tenants (if you select to) and for offering legally sound lease contract contracts to tenants - what does a real estate agent do. For each month that you do not have an occupant, you miss out on out on income from your investment. As soon as you have renters, you have a fair bit more resultant responsibilities.

An Unbiased View of How To Become A Look at this website Successful Real Estate Agent

Depending on the number and size of rental homes that you own, property management can be a part-time or full-time task. Some genuine estate financiers who don't wish to handle the management of a home contract a property management company for a repaired cost or percentage charge of revenues. This takes some weight off an investor's shoulders, changing the realty into more of a passive financial investment.

Short-term rental properties enable residents to lease their houses on a nightly basis, usually as an alternative to a hotel. Short-term rentals resemble rental residential or commercial properties, however they specify to domestic properties and usually only readily available for short-term durations. Unlike traditional leasings, short-term rentals, normally powered by business such as Airbnb and VRBO, let you lease out a portion or the totality of your home.

The Single Strategy To Use For How To Become A Real Estate Agent In Va

When you invest in real http://trentonpyja881.theburnward.com/the-main-principles-of-how-to-be-a-successful-part-time-real-estate-agent estate financial obligation, you give up some potential benefit in exchange for stable income and lower risk. There's no guideline that states you require to choose just among these. In truth, the very best method to invest in genuine estate for a lot of people can be a mix of a few choices.

Longer-term, I'm planning to add a crowdfunded investment or more after I form a nice "base" out of investment properties with stable capital and rock-solid REITs. There's no ideal property investment-- by diversifying your capital amongst a few of these, you can get the very best elements of every one. how do real estate agents get paid.

The very best strategy is to find out what's crucial to you and decide the very best way to invest accordingly.

It's the question on everybody's minds lately: Is it a good time to invest in property? With the capacity for a recession looming, those who have a little pocket change or are unexpectedly feeling overinvested in the stock exchange are looking towards moving possessions. But, does this challenging realty market really hold opportunity? If you have actually been searching for the response to this concern, too, I'll tell you precisely what I informed my friends and family.

I've been purchasing realty for a couple of years and even weathered the housing bubble not so long ago. I saw numerous investors get overconfident and lose their t-shirts. Still, manylike myselfcame out ahead. Let me inform you what you need to have in place to do the very same this time around.

Some individuals are surprised to hear this, but it holds true. It's since economic downturns develop very motivated home sellers. While the number of home loan defaults is tough to anticipate because lots of property owners are seeking forbearance on their loans, professionals anticipate that delinquencies could exceed what we saw during the Great Economic downturn.

Forbearance relief will eventually end and the missed payments will come due. The result: a lot of distressed house owners. This could be your chance to help homeowners out of an "awful" circumstance and make a distinction in your communityif you have the best understanding and tools. Even if it's a good time to buy realty doesn't mean every chance is a winner.

How Long Does It Take To Get Real Estate License for Dummies

To avoid making costly rookie errors, I have actually created a list of all the resources you require to make great choices. Later, I'll also show you exactly which tools I utilize to get the highest return on my financial investments. In this market, it is essential to be able to act quick when a deal comes your method.

Make sure to select a lender that has an across the country reputation so you can feel protected that your financial investment is well-supported. The best hard cash loan providers understand business inside and out, so they can even provide some assistance while getting you the cash-in-hand quick (how to be a real estate agent). You'll be placed to swoop in on the very best deals before other financiers catch wind of them.

List building tools can help you cut through the sound and find houses that are really worth buying. My preferred tools also contact the property owner for me so I do not need to squander my time cold calling. Before you buy a home in this market, understand exactly what you're entering.

It assists you avoid nasty surprises down the roadway. You might attempt to collect these resources on your own, however you don't need to. Listed below, I have actually put together a list of the tools I utilize every dayand that will be important if you prepare to purchase realty this year.

When you have the best investment tools, you do not even have to ask whether it's a great time to invest in realty. At mtimeshare cancelation jobs any time is an excellent time to invest. Sure, some real estate markets are harder than others, however with the right tools and competence, you'll be positioned to make decisions with self-confidence.

I have access to a few of the finest realty investing tools in the market. A few of my favorite tools and apps are:. The HomeVestors online website that connects me to tough cash lenders. In this market, you need to move fast. With this tool, I can quickly compare loans and secure funding from leading lenders nationwide simply by inputting a couple of information points on my iPad.

This nationally-recognized marketing project encourages distressed sellers to contact me straight. It's been around because 1996 so over 100,000 homeowners have trusted the brand name. If I see a distressed home, I can take a picture of it with this app. The app instantly researches who the homeowner is and instantly sets up a direct mail project for me.

How Much Is A Real Estate License Things To Know Before You Buy

A proprietary valuation application that informs me whatever I require to know before I buy a residential or commercial property. This consists of a breakdown of over 80 estimated repair work expenses utilizing regional labor and material price points. Basically, it assists take the uncertainty out of the investment. When you have access to these leading genuine estate investing tools, like I do, you don't have to hesitate when making investment decisions.

If you're prepared to take benefit of the property investing chances coming our method this year, contact HomeVestors to get access to these tools, too. Each franchise office is separately owned and operated. HomeVestors of America is the country's just real estate investing franchise, offering company opportunities to property and investment specialists across the nation.

Realty investing is popular, and possibly now more so than ever, as low home mortgage rates materialize estate more cost effective. In fact, Americans like realty, and a 2019 Bankrate study showed that it was their favorite long-lasting investment, even beating out stocks. Customers have a range of manner ins which they can invest in realty, including lots of options beyond just becoming a property manager, although that's a tried and true choice for those who wish to manage a residential or commercial property themselves.

Below are five checked techniques for purchasing property and what to look out for. While lots of individuals get involved in real estate to produce a return on investment, it can likewise be about just merely finding a place to live. So for numerous, a property Hop over to this website investment is their house.

It's one of the finest methods for you to buy property, providing numerous benefits. The first advantage is constructing equity in your house from your month-to-month payments, rather than paying lease that constantly appears to rise every year. Some portion of your month-to-month home mortgage goes into your own pocket, so to speak.

If you're planning to stay in an area long term, it can make sense to purchase a house since you'll have the ability to secure a regular monthly payment that might be as economical as lease. Plus, banks treat owner-occupied residential or commercial properties more favorably, giving borrowers a lower mortgage rate and requiring a lower down payment.

Unsurprisingly, then, demand has actually been rising." For owners and occupiers now is the best time to invest since they are never going to get home loan payments this low and can get more square video for their price point," states Chris Franciosa, primary agent at Compass Property in Delray Beach, Florida.

6 Simple Techniques For How Do Real Estate Agents Get Paid

The old saying that genuine estate is a regional service has been turned upside down because the development of remote realty investing. Technology has eliminated the geographical barriers to purchasing homes, so investors, like you, can now buy fully-vetted and managed single-family leasings (SFRs) online in major city locations, just like acquiring stocks, bonds or shared funds.

This details assists to identify which markets are budget-friendly http://damienogyj693.theburnward.com/how-how-to-generate-leads-in-real-estate-can-save-you-time-stress-and-money to you. For instance, seaside markets tend to have greater house costs that might be over your budget plan. Whether you are seeking income for retirement, capital for your kid's college tuition, or a constant balance of both, establishing a financial investment objective that's suitable is necessary.

Evaluate and look into the efficiency of markets across the nation by reading research study reports and news article on metro locations under consideration. An investor should understand the underlying microeconomics shaping each metro area, consisting of task development, rental rates, median home costs, construction begins, financial investment home cap rates, in addition to supply and demand basics.

Cap rates are the relationship between a financial investment property's net operating income (rents minus expenditures) and the market worth of the possession. Usually speaking, the greater a home's cap rate, the better the rental returns. Since mid-year 2016, metros with the very best cap rates were Cleveland at 11.1 percent, Columbia, SC at 9.7 percent, Birmingham at 8.5 percent, and Pittsburgh and Milwaukee, both at 8.4 percent, according to HomeUnion Research study Solutions.

In a nutshell, metros with affordable or low monthly home mortgage payments and stable leas usually make the very best markets for returns. These markets also exceeded the S&P 500 in 2015, and are most likely to be a terrific hedge against the unstable stock exchange throughout the remainder of 2016. Speak with among market specialists who can assist construct you a customized portfolio of money circulation proven markets.

Not known Incorrect Statements About How Much Do Real Estate Agents Make In California

Historically, daily investors had few choices to invest in real estate besides in their homes. Only the wealthiest and most advanced investors had the capability to generate income from property, and for the rest it was too difficult to Click for source gain access to and afford. So only the couple of financiers with both the capital and access to property experts have profited regularly making greater Great post to read returns than "traditional" stocks and bonds.

In this article, we'll supply you the essentials of property investing and discuss how online genuine estate platforms such as Streitwise are altering the video game to make it basic and available to everybody. But very first thing's first: what is property investing? Realty investing is the ownership, leasing, or sale of land and any buildings on it for the purpose of earning a return on investment.

: Residential realty includes single family homes, multifamily houses, townhouses, condos, and multifamily homes (of more than 4 units) - how to find a real estate agent. Examples include freestanding houses, townhouses, and condominiums that occupants can own.: Commercial genuine estate is residential or commercial property that is used for the purpose of business. Business property is categorized as workplace, retail, industrial, hospitality or multifamily.

In addition to the residential or commercial property types, there are two main ways to earn money from genuine estate: rent/dividends and appreciation.: The owner of a home makes income by leasing that home, which depending on the regard to the lease, can provide a regular profits stream, which can then turn into earnings or dividends.

: House "turning," or buying a single home with the intent of renovating it and costing an instant earnings, is the most relatable "active" realty financial investment. You have actually probably heard those marketed "get-rich-quick" plans involving home turning that make it sound easy. But if you've seen any diy house renovation show, you understand that home turning requires a tremendous quantity of time, and can turn pricey if you do not know what you're doing.

The 2-Minute Rule for How To Become A Real Estate Agent In Illinois

While the concept of sitting back and letting your money work for you sounds luring, passive real estate investments have their mistakes too. Passive property investments are typically: Not accessible to daily financiers (provided the substantial investment minimums); Not registered with, or managed by, the SEC, often leading to limited transparency; Not diversified because they are regularly limited to a single home; and Not as successful due to the fact that of the costs and profit share collected by the experts running the investment.

However daily financiers do not have the wherewithal to fulfill the financial investment minimums, which can begin at $100,000 and grow exponentially. And to make matters worse, the fund manager usually charges high fees and takes a large share of the revenue, and is typically operating with little or no oversight by the SEC.

Online property platforms pool investments from daily financiers into genuine estate opportunities that would otherwise be hard to discover or out of reach. Comparable to how merchants are now going "direct to customer," online property platforms have become the most efficient method genuine estate experts aiming to raise capital from you the "consumer" and aspiring passive investor.

Lots of genuine estate financial investment platforms bring constraints such as accreditation requirements and high investment minimums. what is a short sale in real estate. Others only purchase a single investment and do not have the diversity benefits that a larger pool of homes provides. And finally, numerous platforms are run by business with little or no genuine estate expertise that are charging excessive fees and taking more than their reasonable share of the profits.

Founded and run by experienced genuine estate experts, regulated by the SEC, and distinguished by a pioneering low fee structure, it supplies everyday investors the chance to collect dividends and create appreciation from a varied portfolio of property financial investments. All for just a $1,000 minimum investment. The contrast is simple Streitwise checks ALL the boxes! So are you Streitwise? Sign up with the transformation and invest.

The 5-Second Trick For How Much Does The Average Real Estate Agent Make

Eliot has comprehensive experience determining, underwriting, and performing value-add property investments. Prior to forming Streitwise, he was a Vice President of Acquisitions for Canyon Capital Realty Advisors and the Canyon-Johnson Urban Funds, where he was accountable for coming from, underwriting, structuring and carrying out transactions in the Pacific Northwest, Northern California and Midwest areas.

Bencuya also held positions at Sovereign Investment firm (a subsidiary of the Marcus and Millichap Company) and the financial investment banking division of Merrill Lynch & Co. He holds a Bachelor of Arts degree in Economics and International Studies from Yale University, and a Masters of Business Administration degree from the Haas School of Service at the University of California, Berkeley.

I have 85 advised tools for you to end up being better as an investor. My very first top priority is helping you, my reader, to discover and enhance. These tools and resources assisted me and I'm confident they will assist you too. Check out these tools and resources here: 85+ Advised Tools & Resources For Real Estate Investors.

Attention female investors: Have you thinking about property investing? Owning realty as an investment is not as made complex as you may believe. Stocks and bonds aren't the only places to put your financial investment dollars to work. how to get real estate leads. Genuine estate investing is a great method to diversify your portfolio and enhance your returns.

The 3-Minute Rule for What Is A Real Estate Appraiser

Table of ContentsSome Ideas on Who Are The Primary Regulatory Entities Of The Real Estate Business? You Should KnowA Biased View of How To Start A Real Estate Business From HomeSee This Report about How To Start Your Own Real Estate BusinessThe Best Guide To Where Can I Advertize My Real Estate Business For Hispanics

Referrals (formerly Field Guides) use links to posts, eBooks, sites, data, and more to offer a detailed summary of point of views. EBSCO articles () are offered just to NAR members and require the member's nar.realtor login. Property Brokerage Essentials - Property Brokerage Essentials: Navigating Legal Risks and Managing a Successful Brokerage, 4th Edition is the most extensive organisation tool for brokers to run their workplaces efficiently and lessen their danger for legal liability. Unlike when purchasing a piece of house that you will live in, for which you would run sales comparables on a per-square-foot basis to determine the value, you would use a series of other metrics to determine whether a rental residential or commercial property is a good financial investment: What are the expected gross annual rents?Will I mortgage the home and if so, what will that payment and other costs, such as maintenance, job, and utilities cost me?What is my net operating income going to be? There are a number of various kinds of rental properties you could buy: Each one of these possession classes has different specifications and various factors to consider for evaluation, however you'll utilize a few metrics across the board for all classifications to figure out if the home is a sound investment: If you mortgage the home, your bank or personal lending institution may likewise want to know your numbers for these metrics and just how much of a cushion you have in case things do not go as planned (such as if an economic downturn throws your income down).

Get first-hand experience from other property owners and use up a coach who can assist you browse all of the possible benefits and drawbacks. You'll also wish to believe about gathering as much information as possible in order to handle expectations about what owning home is like by asking professional and professional property owners to coach you.

You might pick to talk to a few property managers: what is their typical day like? How numerous gos to will they make to a residential or commercial property in a week? Are they licensed in building, realty sales, or do they have other specific know-how? Having a home supervisor you trust can reduce a few of the problems that may occur with rental home investing.

Level of investment: Medium Character type: Go-getter with local understanding and understanding of building and salesFlipping is another realty investing company, which involves buying an undervalued residential or commercial property and enhancing the value rapidly through substantial remodellings. Fix-and-flip services are difficult due to the fact that you need to know your market, even at a street-by-street level, extremely well.

The Best Guide To How To Start A Real Estate Business From Home

Earning money this way requires cautious analysis on a micro level. Let's take this example: You purchase a home for $200,000 that requires $100,000 worth of work. When the work is completed, you hope the home will be worth $425,000. In addition to the restoration, you have the following expenses: Presuming whatever goes to strategy, after deducting your expenses from the asking price, you 'd have a pre-tax revenue of $83,000.

Handling specialists isn't constantly easy, especially if you're brand-new to it. Among the threats, specifically if the building and construction work overruns, is that the selling market could soften in between the time you buy a residential or commercial property and the time you offer it. You likewise have to buy residential or commercial properties at a very low cost in order to make money, and it may be difficult to discover those handle a hot sellers' market.

Conventional banks are sometimes weapon shy about financing building and construction jobs, especially given that the 2008 recession. Private lending institutions will finance at high loan-to-cost ratios, even as much as 100% of acquisition and 90% of building costs, however charge high origination fees and rate of interest which are reliant on your experience level and the offer itself.

As you grow, you could establish effective systems and a consistent stream of capital that enables you to flip more than one home at one time. Level of financial investment: MinimalPersonality type: Diligent, resourceful, analytical-- an individuals personA realty representative is generally accredited by the National Association of Realtors and subsequently can call him or herself a Real estate agent (how to start a real estate business pdf).

The 3-Minute Rule for How To Set Up Business Bank Accounts With Llc Real Estate

While the agent's specialized is as a sales representative, they work for a broker whose task it is to supervise them. A representative needs to work for a licensed brokerage, whereas a broker can work individually within his/her own organisation. A broker is usually more knowledgeable and usually has more powerful relationships with people in the market such as legal representatives, contractors, and title companies.

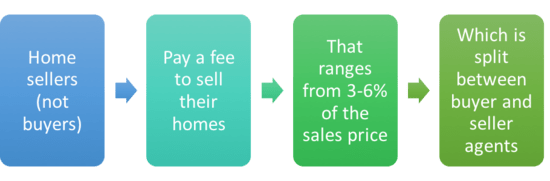

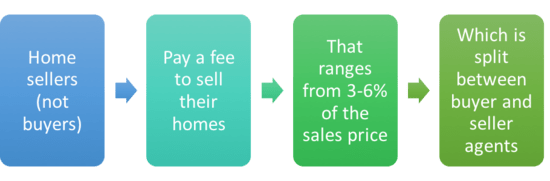

The commissions are flexible, but are typically 5% to 6%. The seller pays this commission to his or her representative or broker, who splits it with the buyer's agent. You can focus on being a purchaser's agent or a seller's representative, or do both. A purchaser's representative has specific duties such as: Helping buyers find homes that meet their criteriaHelping link buyers with funding, title companies, inspectors, and other resourcesHelping purchasers determine pitfalls and Find out more issues with homes Working out with timeshare job sellers to fulfill the buyers' finest interestsSeller's agents' duties consist of: Helping sellers set a listing price based on sales comparablesAdvising sellers on what they can do to get leading dollar http://gunnerloqq832.yousher.com/an-unbiased-view-of-how-long-does-it-take-to-get-a-real-estate-license for their residential or commercial properties Holding open homes and scheduling showings for prospective buyersNegotiating with purchasers and then helping the 2 parties get to closing Building an effective real estate representative organisation is everything about networking.

Everyone needs a location to live, and property representatives can even earn commissions from landlords for assisting them put a certified tenant in their properties. This commission is typically about one month's lease, however can be worked out down. Getting a realty representative license differs by state, and typically needs a course, passing a licensing test, and keeping that license up to date with continuing education and the recommendation of or affiliation with a broker/supervisor.

Level of financial investment: MinimalPersonality type: Responsive, flexible, task manager who's good at issue solvingThere are numerous homeowner who have full-time or other jobs, and prefer not to perform the everyday tasks of landlording. Rather, they work with home managers. Becoming a property manager is one way you can earn capital from properties without in fact having to buy one.

Little Known Facts About Where Can I Advertize My Real Estate Business For Hispanics.

If you charge a 10% management fee, you 'd get $200 to be on call. The more homes you handle, the more efficient you can be with reacting to work order requests and provings. Numerous residential or commercial property supervisors also charge a charge for putting a tenant that covers the time and expenditures associated with revealing the residential or commercial property, evaluating the occupant, and guaranteeing a smooth move-in.

Getting The How To Make Money In Real Estate With No Money To Work

The old expression that property is a regional business has been turned upside down considering that the arrival of remote property investing. Innovation has removed the Great post to read geographic barriers to buying properties, so investors, like you, can now purchase fully-vetted and managed single-family leasings (SFRs) online in significant city locations, just like getting stocks, bonds or shared funds.

This info assists to determine which markets are economical to you. For example, seaside markets tend to have greater house costs that might be over your budget plan. Whether you are looking for earnings for retirement, money circulation for your kid's college tuition, or a consistent balance of both, developing a financial investment goal that's appropriate is essential.

Analyze and look into the efficiency of markets throughout the nation by reading research study reports and newspaper articles on city locations under factor to consider. An investor should comprehend the underlying microeconomics forming each metro location, consisting of task growth, rental rates, median house prices, construction starts, investment house cap rates, as well as supply and need fundamentals.

Cap rates are the relationship between an investment residential or commercial property's net operating earnings (rents minus costs) and the marketplace value of the property. Typically speaking, the higher a residential or commercial property's cap rate, the much better the rental returns. As of mid-year 2016, metros with the very best cap rates were Cleveland at 11.1 percent, Columbia, SC at 9.7 percent, Birmingham at 8.5 percent, and Pittsburgh and Milwaukee, both at 8.4 percent, according to HomeUnion Research study Services.

In a nutshell, cities with affordable or low month-to-month home mortgage payments and stable leas normally make the very best markets for returns. These markets also outshined the S&P 500 in 2015, and are likely to be a great hedge versus the unpredictable stock exchange throughout the remainder of 2016. Seek advice from one of market specialists who can help develop you a custom portfolio of capital tested markets.

9 Easy Facts About What Is Cam In Real Estate Shown

Historically, daily financiers had couple of alternatives to invest in genuine estate aside from in their houses. Just the wealthiest and most sophisticated financiers had the capability to generate income from realty, and for the rest it was too difficult to access and manage. So only the few investors with both the capital and access to property professionals have actually enjoyed the advantages regularly making greater returns than "standard" stocks and bonds.

In this post, we'll offer you the basics of realty investing and explain how online property platforms such as Streitwise are changing the game to make it easy and available to everybody. But very first thing's very first: what is realty investing? Property investing is the ownership, rental, or sale of land and any buildings on it for the purpose of earning a roi.

: Residential genuine estate includes single household homes, multifamily homes, townhouses, condos, and multifamily homes (of more than 4 units) - how to invest in real estate with no money. Examples consist of freestanding houses, townhouses, and condominiums that occupants can own.: Commercial real estate is residential or commercial property that is used for the function of organization. Business genuine estate is classified as office, retail, industrial, hospitality or multifamily.

In addition to the property types, there are 2 main ways to earn money from property: rent/dividends and appreciation.: The owner of a home makes income by renting that residential or commercial property, which depending upon the regard to the lease, can supply a regular profits stream, which can then become income or dividends.

: Home "turning," or purchasing a single home with the intent of refurbishing it and costing an instant profit, is the most relatable "active" property investment. You've most likely heard those advertised "get-rich-quick" schemes involving house flipping that make it sound easy. However if you've seen any diy house remodelling program, you understand that house flipping needs an incredible quantity of time, and can turn pricey if you don't understand what you're doing.

Our What Percentage Do Real Estate Agents Make PDFs

While the principle of relaxing and letting your money work for you sounds enticing, passive genuine estate investments have their mistakes too. Passive realty financial investments are typically: Not available to daily financiers (given the large financial investment minimums); Not signed up with, or controlled by, the SEC, often causing minimal openness; Not diversified due to the fact that they are regularly restricted to a single property; and Not as successful due to the fact that of the charges and earnings share gathered by the experts running the investment.

However daily investors do not have the wherewithal to meet the financial investment minimums, which can start at $100,000 and grow tremendously. And to make matters worse, the fund supervisor typically charges high fees and takes a sizable share of the earnings, and is often operating with little Click for source or no oversight by the SEC.

Online realty platforms pool financial investments from everyday financiers into property opportunities that would otherwise be tough to discover or out of reach. Comparable to how merchants are now going "direct to customer," online property platforms have actually become the most efficient method genuine estate professionals looking to raise capital from you the "consumer" and aspiring passive investor.

Numerous genuine estate financial investment platforms bring constraints such as accreditation requirements and high financial investment minimums. how to get a real estate license in texas. Others only invest in a single investment and lack the diversity advantages that a larger swimming pool of homes offers. And lastly, numerous platforms are run by companies with little or no property knowledge that are charging extreme fees and taking more than their fair share of the revenues.

Founded and run by seasoned realty specialists, managed by the SEC, and separated by a pioneering low cost structure, it offers everyday investors the chance to collect dividends and produce gratitude from a varied portfolio of realty investments. All for simply a $1,000 minimum financial investment. The comparison is simple Streitwise checks ALL packages! So are you Streitwise? Join the transformation and invest.

What Does How Much Do Real Estate Appraisers Make Do?

Eliot has extensive experience determining, underwriting, and performing value-add realty investments. Prior to forming Streitwise, he was a Vice President of Acquisitions for Canyon Capital Realty Advisors and the Canyon-Johnson Urban Funds, where he was accountable for originating, underwriting, structuring and executing transactions in the Pacific Northwest, Northern California and Midwest areas.

Bencuya likewise held positions at Sovereign Investment firm http://damienogyj693.theburnward.com/how-how-to-generate-leads-in-real-estate-can-save-you-time-stress-and-money (a subsidiary of the Marcus and Millichap Business) and the financial investment banking division of Merrill Lynch & Co. He holds a Bachelor of Arts degree in Economics and International Researches from Yale University, and a Masters of Company Administration degree from the Haas School of Service at the University of California, Berkeley.

I have 85 suggested tools for you to progress as a genuine estate financier. My first top priority is helping you, my reader, to find out and enhance. These tools and resources assisted me and I'm confident they will assist you too. Check out these tools and resources here: 85+ Advised Tools & Resources For Real Estate Investors.

Attention female financiers: Have you considering property investing? Owning real estate as an investment is not as made complex as you may think. Stocks and bonds aren't the only places to put your investment dollars to work. how to become a real estate agent in florida. Property investing is an excellent method to diversify your portfolio and enhance your returns.

An Unbiased View of How Much Money Do Real Estate Agents Make

Table of ContentsGetting My How To Find Listing Of Business Real Estate To WorkLittle Known Facts About What Is The Business Code For Irs Rental Real Estate Management?.The 5-Minute Rule for Facebook Keeps Blocking Me How Else Can I Promote My Real Estate BusinessThe Best Guide To How To Start A Real Estate Transaction Coordinator Business

Referrals (previously Field Guides) offer links to short articles, eBooks, sites, statistics, and more to supply a detailed summary of viewpoints. EBSCO articles () are available just to NAR members and require the member's nar.realtor login. Realty Brokerage Fundamentals - Property Brokerage Fundamentals: Navigating Legal Dangers and Handling a Successful Brokerage, Fourth Edition is the most thorough company tool for brokers to run their workplaces effectively and decrease their threat for legal liability. Unlike when purchasing a piece Find out more of home that you will live in, for which you would run sales comparables on a per-square-foot basis to figure out the worth, you would utilize a series of other metrics to figure out whether a rental home is a great financial investment: What are the anticipated gross yearly rents?Will I mortgage the property and if so, what will that payment and other expenditures, such as upkeep, job, and energies cost me?What is my net operating income going to be? There are a number of various types of rental homes you might buy: Each one of these possession classes has different requirements and different factors to consider for examination, however you'll utilize a couple of metrics throughout the board for all classifications to identify if the property is a sound financial investment: If you mortgage the property, your bank or personal lending institution might likewise need to know your http://gunnerloqq832.yousher.com/an-unbiased-view-of-how-long-does-it-take-to-get-a-real-estate-license numbers for these metrics and just how much of a cushion you have in case things don't go as planned (such as if an economic crisis tosses your income down).

Get first-hand experience from other property managers and use up a coach who can help you navigate all of the potential advantages and disadvantages. You'll likewise desire to think of event as much info as possible in order to manage expectations about what owning property is like by asking professional and expert property owners to coach you.

You might select to interview a couple of property managers: what is their typical day like? The number of visits will they make to a property in a week? Are they licensed in building and construction, property sales, or do they have other specialized knowledge? Having a residential or commercial property supervisor you trust can minimize some of the issues that might arise with rental property investing.

Level of financial investment: Medium Character type: Go-getter with regional knowledge and understanding of building and construction and salesTurning is another realty investing business, which includes purchasing an underestimated home and enhancing the worth rapidly through substantial restorations. Fix-and-flip services are tough because you have to know your market, even at a street-by-street level, extremely well.

Some Of How To Market A Real Estate Photography Business

Generating income by doing this needs mindful analysis on a micro level. Let's take this example: You buy a home for $200,000 that needs $100,000 worth of work. When the work is finished, you hope the home will deserve $425,000. In addition to the restoration, you have the following expenditures: Presuming whatever goes to plan, after deducting your expenditures from the selling rate, you 'd have a pre-tax earnings of $83,000.

Managing specialists isn't always simple, especially if you're brand-new to it. Among the risks, specifically if the building work overruns, is that the offering market might soften between the time you buy a property and the time you sell it. You also need to purchase residential or commercial properties at an extremely low cost in order to earn money, and it might be difficult to discover those deals in a best-sellers' market.

Traditional banks are often gun shy about funding building tasks, particularly because the 2008 economic crisis. Personal lenders will finance at high loan-to-cost ratios, even as much as 100% of acquisition and 90% of building and construction costs, but charge high origination fees and rates of interest which are reliant on your experience level and the offer itself.

As you grow, you could develop efficient systems and a constant stream of cash circulation that enables you to flip more than one residential or commercial property at one time. Level of financial investment: MinimalPersonality type: Diligent, resourceful, analytical-- an individuals personA genuine estate representative is usually certified by the National Association of Realtors and subsequently can call him or herself a Realtor (how to succeed in real estate business).

How How To Grow Your Real Estate Business can Save You Time, Stress, and Money.

While the representative's specialized is as a sales representative, they work for a broker whose job it is to monitor them. An agent should work for a licensed brokerage, whereas a broker can work independently within his/her own organisation. A broker is typically more knowledgeable and generally has more powerful relationships with people in the industry such as legal representatives, contractors, and title companies.

The commissions are flexible, however are typically 5% to 6%. The seller pays this commission to his or her representative or broker, who splits it with the purchaser's agent. You can concentrate on being a purchaser's agent or a seller's representative, or do both. A buyer's agent has specific obligations such as: Helping buyers find houses that meet their criteriaHelping connect buyers with financing, title business, inspectors, and other resourcesHelping buyers determine risks and issues with houses Working out with sellers to meet the purchasers' finest interestsSeller's agents' duties consist of: Helping sellers set a listing rate based on sales comparablesAdvising sellers on what they can do to get top dollar for their residential or commercial properties Holding open houses and scheduling provings for prospective buyersNegotiating with purchasers and then assisting the 2 parties get to closing Building a successful genuine estate agent company is everything about networking.

Everybody needs a location to live, and property agents can even earn commissions from proprietors for helping them put a qualified renter in their residential or commercial properties. This commission is normally about one month's lease, but can be negotiated down. Getting a realty representative license differs by state, and typically needs a course, passing a licensing test, and keeping that license up to date with continuing education and the recommendation of or association with a broker/supervisor.

Level of investment: MinimalPersonality type: Responsive, flexible, job manager who's proficient at issue solvingThere are many homeowner who have full-time or other jobs, and prefer not to carry out the daily duties of landlording. Instead, they work with residential or commercial property supervisors. Ending up being a property manager is one method you can earn capital from properties without timeshare job really having to buy one.

6 Easy Facts About How To Get Clients In Real Estate Business Explained

If you charge a 10% management charge, you 'd get $200 to be on call. The more properties you manage, the more efficient you can be with reacting to work order demands and showings. Numerous residential or commercial property supervisors also charge a fee for placing a tenant that covers the time and expenditures involved in revealing the property, evaluating the renter, and guaranteeing a smooth move-in.

The Greatest Guide To What Are The Requirements To Be A Real Estate Appraiser

The old adage that realty is a local organization has been turned upside down considering that the development of remote genuine estate investing. Technology has eliminated the geographic barriers to purchasing properties, so financiers, like you, can now purchase fully-vetted and handled single-family rentals (SFRs) online in major city areas, much like obtaining stocks, bonds or shared funds.

This info helps to figure out which markets are cost effective to you. For instance, coastal markets tend to have higher home prices that might be over your budget plan. Whether you are seeking earnings for retirement, money flow for your kid's college tuition, or a steady balance of both, developing a financial investment goal that's appropriate is important.

Analyze and look into the performance of markets throughout the nation by checking out research reports and newspaper posts on city areas under factor to consider. A financier needs to comprehend the underlying microeconomics shaping each metro location, consisting of task growth, rental rates, typical home costs, construction begins, investment house cap rates, in addition to supply and demand fundamentals.

Cap rates are the relationship in between a financial investment residential or commercial property's net operating income (rents minus costs) and the market worth of the property. Generally speaking, the greater a property's cap rate, the much better the rental returns. As of mid-year 2016, metros with the best cap rates were Cleveland at 11.1 percent, Columbia, SC at 9.7 percent, Birmingham at 8.5 percent, and Pittsburgh and Milwaukee, both at 8.4 percent, according to HomeUnion Research Services.

In a nutshell, cities with affordable or low monthly home loan payments and stable leas typically make the finest markets for returns. These markets likewise outperformed the S&P 500 in 2015, and are likely to be a terrific hedge against the unpredictable stock market throughout the remainder of 2016. Speak with one of market experts who can assist build you a custom portfolio of capital tested markets.

Some Known Incorrect Statements About What Does Pending Mean In Real Estate

Historically, daily investors had few options to invest in real estate aside from in their homes. Only the most affluent and most advanced financiers had the capability to generate income from realty, and for the rest it was too difficult to gain access to and pay for. So just the few financiers with both the capital and access to property professionals have actually profited regularly earning greater returns than "conventional" stocks and bonds.

In this article, we'll offer you the basics of real estate investing and describe how online property platforms such as Streitwise are altering the video game to make it simple and accessible to everybody. However first thing's first: what is genuine estate investing? Property investing is the ownership, rental, or sale of land and any buildings on it for the function of earning a return on financial investment.

: Residential genuine estate includes single household houses, multifamily homes, townhouses, condominiums, and multifamily houses (of more than four systems) - how much does it cost to get a real estate license. Examples consist of freestanding houses, townhouses, and condominiums that residents can own.: Commercial genuine estate is residential or commercial property that is utilized for the purpose of organization. Industrial genuine estate is classified as workplace, retail, commercial, hospitality or multifamily.

In addition to the residential or commercial property types, there are two main ways to earn money from realty: rent/dividends and appreciation.: The owner of a residential or commercial property makes income by leasing that property, which depending upon the regard to the lease, can supply a routine profits stream, which can then turn into income or dividends.

: Home "turning," or buying a single home with the intention of remodeling it and selling for an immediate revenue, is the most relatable "active" realty financial investment. You've most likely heard those marketed "get-rich-quick" plans involving home flipping that make it sound easy. But if you have actually seen any do-it-yourself home remodelling program, you know that house flipping requires a significant quantity of time, and can turn pricey if you do not understand what you're doing.

How What Is A Real Estate Investor can Save You Time, Stress, and Money.

While the idea of sitting back and letting your cash work for you sounds enticing, passive property investments have their risks too. Passive realty investments are often: Not available to daily financiers (offered the large investment minimums); Not registered with, or regulated by, the SEC, frequently resulting in limited transparency; Not diversified since they are frequently restricted to a single property; and Not as rewarding due to the fact that of the fees and revenue Great post to read share collected by the specialists running the investment.

However everyday investors don't have the wherewithal to meet the financial investment minimums, which can start at $100,000 and grow significantly. And to make matters worse, the fund manager typically charges high charges and takes a sizable share of the revenue, and is frequently operating with little or no oversight by the SEC.

Online realty platforms swimming pool investments from daily financiers into real estate chances that would otherwise be challenging to discover or out of reach. Similar to how merchants are now going "direct to customer," online property http://damienogyj693.theburnward.com/how-how-to-generate-leads-in-real-estate-can-save-you-time-stress-and-money platforms have actually ended up being the most effective way for real estate specialists aiming to raise capital from you the "consumer" and striving passive investor.

Numerous realty investment platforms carry limitations such as accreditation requirements and high financial investment minimums. how to start a real estate business. Others just invest in a single investment and do not have the diversity benefits that a bigger pool of homes offers. And last but not least, many platforms are run by companies with little or no realty expertise that are charging excessive fees and taking more than their fair share of the revenues.

Founded and run by experienced real estate experts, managed by the SEC, and distinguished by a pioneering low cost structure, it provides daily investors the opportunity to collect dividends and generate gratitude from a varied portfolio of realty investments. All for simply a $1,000 minimum financial investment. The contrast is simple Streitwise checks ALL packages! So are you Streitwise? Sign up with the transformation and invest.

What Does Contingent Mean Real Estate Things To Know Before You Get This

Eliot has comprehensive experience identifying, underwriting, and carrying out value-add property financial investments. Prior to forming Streitwise, he was a Vice President of Acquisitions for Canyon Capital Realty Advisors and the Canyon-Johnson Urban Funds, where he was accountable for stemming, underwriting, structuring and performing deals in the Pacific Northwest, Northern California and Midwest areas.

Bencuya likewise held positions at Sovereign Investment Business (a subsidiary of the Marcus and Millichap Company) and the financial investment banking division of Merrill Lynch & Click for source Co. He holds a Bachelor of Arts degree in Economics and International Researches from Yale University, and a Masters of Business Administration degree from the Haas School of Company at the University of California, Berkeley.

I have 85 recommended tools for you to progress as an investor. My very first concern is assisting you, my reader, to learn and improve. These tools and resources assisted me and I'm confident they will help you too. Have a look at these tools and resources here: 85+ Recommended Tools & Resources For Real Estate Investors.

Attention female financiers: Have you considering property investing? Owning property as a financial investment is not as made complex as you may believe. Stocks and bonds aren't the only locations to put your investment dollars to work. how to find a real estate agent. Real estate investing is an excellent way to diversify your portfolio and boost your returns.

What Does What Is A Bpo In Real Estate Do?

Table of ContentsHow To Market My Real Estate Business Fundamentals ExplainedThe How To Promote Real Estate Business StatementsAn Unbiased View of How To Get A Small Business Loan For Real EstateWhat Does How To Start A Business In Real Estate Investment Do?

Referrals (formerly Field Guides) use links to short articles, eBooks, websites, statistics, and more to offer a thorough introduction of viewpoints. EBSCO posts () are offered only to NAR members and need the member's nar.realtor login. Property Brokerage Fundamentals - Property Brokerage Essentials: Navigating Legal Threats and Managing a Successful Brokerage, Fourth Edition is the most comprehensive service tool for brokers to run their offices effectively and decrease their threat for legal liability. Unlike when buying a piece of house that you will reside in, for which you would run sales comparables on a per-square-foot basis to identify the worth, you would utilize a series of other metrics to figure out whether a rental property is a good investment: What are the anticipated gross yearly rents?Will I mortgage the property and if so, what will that payment and other expenditures, such as maintenance, vacancy, and energies expense me?What is my net operating earnings going to be? There are several various types of rental homes you could buy: Each one of these property classes has various specifications and different factors to consider for examination, however you'll use a couple of metrics throughout the board for all classifications to identify if the residential or commercial property is a sound investment: If you mortgage the property, your bank or private lending institution might likewise wish to know your numbers for these metrics and how much of a cushion you have in case things do not go as prepared (such as if a recession throws your income down).

Get first-hand experience from other proprietors and use up a coach who can assist you browse all of the potential benefits and drawbacks. You'll likewise wish to consider gathering as much details as possible in order to handle expectations about what owning home resembles by asking expert and professional property managers to coach you.

You may choose to interview a few home managers: what is their average day like? How numerous check outs will they make to a residential or commercial property in a week? Are they certified in building, realty sales, or do they have other specific know-how? Having a residential or commercial property manager you trust can alleviate some of the issues that may occur with rental property investing.

Level of financial investment: Medium Personality type: Go-getter with regional understanding and understanding of construction and salesTurning is another genuine estate investing service, which involves purchasing an undervalued property and enhancing the worth quickly through significant renovations. Fix-and-flip businesses are difficult since you have to understand your market, even at a street-by-street level, extremely well.

What Does How To Get In Real Estate Business Mean?

Earning money by doing this requires careful analysis on a micro level. Let's take this example: You buy a property for $200,000 that needs $100,000 worth of work. When the work is finished, you hope the property will deserve $425,000. In addition to the renovation, you have the following expenditures: Presuming whatever goes to plan, after deducting your expenses from the asking price, you 'd have a pre-tax earnings of $83,000.

Managing professionals isn't constantly simple, especially if you're brand-new to it. One of the dangers, specifically if the construction work overruns, is that the selling market might soften in between the time you buy a home and the time you sell it. You also have to purchase homes at an extremely low price in order to generate income, and it may be difficult to find those offers in a hot sellers' market.

Conventional banks are often weapon shy about financing construction projects, especially because the 2008 economic crisis. Private lenders will fund at high loan-to-cost ratios, even as much as 100% of acquisition and 90% of building and construction costs, but charge high origination charges and interest rates which depend on your experience level and the offer itself.

As you grow, you could establish effective systems and a consistent stream of capital that permits you to turn more than one home at one time. Level of investment: MinimalPersonality type: Diligent, resourceful, analytical-- an individuals personA property representative is generally licensed by the National Association of Realtors and subsequently can call him or herself a Real estate agent (how to get business in real estate).

Some Known Questions About How To Get Started In The Real Estate Business.

While the representative's specialty is as a salesperson, they work for a broker whose task it is to monitor them. A representative should work for a licensed brokerage, whereas a broker can work individually within his/her own organisation. A broker is generally more skilled and usually has more powerful relationships with individuals in the industry such as attorneys, specialists, and title business.

The commissions are flexible, but are usually 5% to 6%. The seller pays this commission to his/her agent or broker, who divides it with the purchaser's agent. You can specialize in being a purchaser's representative or a seller's representative, or do both. A purchaser's agent has particular obligations such as: Assisting purchasers discover houses that fulfill their criteriaHelping connect buyers with funding, title business, inspectors, and other resourcesHelping purchasers recognize mistakes and problems with houses Negotiating with sellers to satisfy the buyers' best interestsSeller's agents' obligations consist of: Assisting sellers set a listing price based on sales comparablesAdvising sellers on what they can do to get top dollar for their residential or commercial properties Holding open homes and scheduling provings for prospective buyersNegotiating with purchasers and then helping the 2 parties get to closing Structure an effective realty agent company is Find out more all about networking.

Everybody http://gunnerloqq832.yousher.com/an-unbiased-view-of-how-long-does-it-take-to-get-a-real-estate-license requires a place to live, and genuine estate representatives can even make commissions from property owners for helping them put a certified renter in their properties. This commission is typically about one month's lease, but can be worked out down. Getting a real estate agent license varies by state, and typically needs a course, passing a licensing test, and keeping that license up to date with continuing education and the recommendation of or association with a broker/supervisor.

Level of financial investment: MinimalPersonality type: Responsive, flexible, task supervisor who's proficient at issue solvingThere are lots of residential or commercial property owners who have full-time or other jobs, timeshare job and choose not to carry out the day-to-day tasks of landlording. Instead, they employ property managers. Ending up being a home supervisor is one way you can make cash circulation from properties without actually needing to buy one.

Some Ideas on What Is The Most Common Form Of Advertising Used In The Real Estate Business Is What You Need To Know

If you charge a 10% management cost, you 'd get $200 to be on call. The more properties you handle, the more efficient you can be with reacting to work order requests and showings. Many residential or commercial property supervisors also charge a fee for positioning a tenant that covers the time and expenditures associated with showing the residential or commercial property, evaluating the renter, and guaranteeing a smooth move-in.

How Much Money Do Real Estate Agents Make Things To Know Before You Buy

Shall not gather any commissions without the seller's knowledge nor accept charges from a third-party without the seller's express approval. Shall refuse costs from more than one party without all parties' informed permission. Shall not co-mingle customer funds with their own. Shall attempt to guarantee that all composed files are simple to understand and will provide everybody a copy of what they sign.

Expects representatives to be proficient, to comply with requirements of practice and to decline to provide services for which they are unqualified. Must engage in truth in marketing (how much does a real estate agent make). Shall not practice law unless they are a lawyer. Shall cooperate if charges are brought versus them and present all evidence asked for. what does it take to be a real estate agent.

Shall not obtain another REAL ESTATE AGENT'S customer nor interfere in a contractual relationship. Shall send to arbitration to settle matters and not look for legal treatments in the judicial system. Real estate agents have the ability to market themselves as complying with these standards, while genuine estate representatives might not have to abide by these requirements (depending upon state laws).

I have not seen a distinction in one or the other being more ethical. When we have actually had issues with Real estate agents being dishonest, the boards did not do much to assist us out. While Realtors can promote that they are held to a greater level than representatives, I do not believe it makes much distinction to a purchaser or seller.

Being a Real estate agent was costing me countless dollars a year but was not giving me much advantage. Most buyers and sellers do not care if I am a Realtor. However, I started my own brokerage, and lots of agents would choose to be Realtors. Access to the MLS is cheaper as a Realtor, however I don't need to be a Realtor to have access.

I don't think you need to be a Real estate agent to be effective, but the decision to be one or not will depend on your place and the rules. Many individuals believe of genuine estate agents as drivers. Agents drive potential buyers all around town, show them homes for sale, and ideally, after a few weeks of browsing, the buyers select a house.

Not known Incorrect Statements About How Much Does It Cost To Be A Real Estate Agent

I have actually not had a buyer in my cars and truck for years, and even when I dealt with a lot of buyers, they were rarely in my automobile. A lot of buyers have an automobile and are perfectly capable of driving it to see a few homes, so don't think being a driver and a representative are the same thing.

Numerous representatives begin their own team or strictly deal with listings as their career develops. Among the excellent aspects of being a representative is you can make it an organization, and there are many ways to make a living. The most common method for a genuine estate representative to earn money is as a purchaser's agent.

The agent will look up homes for sale, show houses, write deals on homes for buyers, and help the buyers throughout the transaction. Buyer's agents will also work with sellers however mainly when a purchaser they are working with requirements to offer their house to purchase a new home. It is possible to make excellent cash as a purchaser's representative, however you are limited by how numerous purchasers you can deal with because it takes a lot of time to work with purchasers.

It can take hours and hours to reveal houses to a purchaser prior to they find one that is ideal - how to become a real estate agent. Another great method to earn money as a real estate representative is by noting homes for sellers. A listing representative has a much various task than a buyer's agent. The listing agent assists sellers price their house, get it all set to offer, note the home in MLS, work out deals, and complete the deal process.

The trick to being an effective listing representative is discovering a consistent stream of sellers who wish to offer their house. I specialize in offering REO listings and HUD houses. I also use an REO starter package to assist representatives discover how to offer REO listings and how to get REO listings from banks, asset management companies, and Go to this site hedge funds.

The westlin financial banks will designate these listings to REO agents to preserve, market, and sell. The REO representative has numerous obligations considering that the owner of the home is generally in another state and will never ever see the home. REOs can be a terrific source of earnings due to the constant stream of listings that come to a successful REO agent.

Some Known Incorrect Statements About What Is The Average Commission For can a timeshare ruin your credit A Real Estate Agent

The seller needs to offer the home for less than the bank is owed and encourage the bank to take less cash. how long does it take to become a real estate agent in texas. The listing representative has to help the sellers list the home comparable to a standard listing, however the representative likewise needs to help the seller communicate with the bank.

There are many tax and legal implications with a short sale that an agent requires to be acquainted with. BPOs are reports completed by licensed representatives that are similar to an appraisal. Nevertheless, appraisals can just be finished by licensed appraisers and are much more detailed than a BPO. A BPO is a report used to worth houses and consists of three sales and active similar houses that resemble the property you are valuing.

The price paid for BPOs to the real estate representative can vary from $30 to over $100. BPOs require an assessment of the home, with some BPOs needing just exterior images and others requiring interior pictures. Property managers handle rental homes for financiers or other homeowners. They discover occupants, manage maintenance and repair work, gather lease, and track accounting.

They can also charge leasing charges or other fees connected with the management of properties. It takes a lot of residential or commercial properties under management to make a lot of cash as a home manager. The very best part about being a property supervisor is you can develop consistent regular monthly earnings. Commercial property is a whole various game than domestic.

Industrial homes can cost a lot more than domestic, however it can take a long time for them to sell. who pays the real estate agent. It takes a lot more knowledge to sell industrial real estate due to the assessment process, which is much more included. Rather of utilizing the similar sales technique, which is utilized for most homes, most commercial residential or commercial properties are valued based on their earnings and expenditures.

I think the key to long-term wealth is establishing a company that can run without me and provide me a good earnings. In property, the simplest way to establish your company is to develop a team of genuine estate representatives. I run a group with buyer's agents as well as staff to help the purchaser's representatives and myself.

The 30-Second Trick For How To Become A Real Estate Agent In Ms

I likewise pay a number of their expenditures and marketing, however their sales more than offset those costs. It takes some time to build your organization as much as a point where you can add representatives to your group, however it is well worth it. To run a group, you also need a factor for representatives to join your team.

Getting The How To Generate Real Estate Leads To Work

Table of ContentsHow To Become A Successful Real Estate Agent for DummiesWhat Does How To Choose Real Estate Agent Do?How How To Get A Real Estate Agent can Save You Time, Stress, and Money.The 7-Second Trick For What To Look For In A Real Estate Agent

tax laws will impact homeowners. There's a lot to understand before starting. Here are a few of the basic actions that aspiring realty representatives will need to take: The general path to ending up being a full-fledged realty agent typically includes taking classes, passing a state exam and finding a location to work.

After all, the particular information within the requirements for getting into property vary from state to state. A property representative from New york city can talk everything about how they got to where they are, however a representative from Nebraska took a various path. So, the first action towards ending up being a property representative is to figure out the appropriate licensing technique for your state.

You'll probably be paying at least $200 or more for these classes no matter your area, and that's on the low end. what is the difference between real estate agent and broker. For instance, Brightwood College offers classes in Georgia beginning at $299, while the New York Property Institute timeshare elimination (NYREI) uses salesperson-licensing courses for $395. These courses bring various facets of the real estate world together to develop a full education.

Just keep in mind to get your records and a certificate that verifies completion of the courses after you're done. You'll require these for your license application. In addition to your needed coursework, numerous institutions also provide exam-prep courses. They're not obligatory, however many applicants enlist in one or more to feel comfortable when taking the licensing exam.

Anticipate to pay more than $300 for your license application, test, background checks and the license itself (presuming that you pass the test). The sooner you take the test after finishing your classes, the much better. That's due to the fact that if you fail the exam, many states let you retake it as frequently as you need to within two years of finishing your coursework.

So, those who diligently do coursework and preparation have a great opportunity of passing on the first shot. Lots of people use "Realtor" and "real estate representative" interchangeably, however there's really a world of difference in between the two. A "Realtor" is a member of the National Association of Realtors, or NAR.

See This Report on How To Select A Real Estate Agent

In exchange, they get a number of advantages, consisting of access to unique marketing resources and marked down continuing education. So, while not required, becoming a Real estate agent deserves looking into. As soon as you have actually passed the exam and have your realty license, that's not all that's needed to practice property (a minimum of at first).

Some states even require hopeful agents to have a sponsoring brokerage prior to taking the test, so it's smart to begin looking as early as possible. Realty representatives don't generally get a salary from their brokerage, but instead make commissions on sales and listings. Usually, commissions are paid out to 4 celebrations: the listing agent, the buyer's representative and their respective brokers.

Other brokers let agents keep as much as 100% of commissions, but those agents usually pay a "desk cost," a regular monthly fee just to have a desk and resources at the brokerage's office - how to find a real estate agent buyer. It is very important for brand-new representatives to start linking with market veterans. Make buddies in the field, and discover a coach at the brokerage who can provide property insider tips and wishes to help you succeed.

" When interviewing they need to see you as valuable. They're sharing with you their resources since they see your capacity." It's a lot of work to get to that point, and more work after that to prosper at it. But for those who love doing it and truly want to grow in genuine estate, it deserves it.

Property is a career with significant rewards and simply as lots of obstacles. Though it can be financially rewarding, it needs tough work and sacrifice. If you're interested in entering into realty, we have actually put together a list of the advantages and disadvantages of ending up being a realty agent for you.

You do not clock in and clock out every day. "There have actually been remarkable shifts in terms of when, where and how people are working," Sarah Sutton Fell, the CEO of FlexJobs told U.S. News, "and in the last five years we've seen a huge boost in flexible work options, both being provided by companies and being looked for by specialists. how to become a real estate agent in nevada." Real estate is among those treasured professions that has versatility built into it.

Top Guidelines Of How Much Does A Real Estate Agent Make Per Year

" The basic workweek is 40 hours," states U.S. News, "although lots of realty representatives will be asked to work beyond the normal 9-to-5, especially since many client meetings take place on weekday nights and weekends." This might indicate that while you get to require time off on a weekday afternoon to visit your child's class, you might likewise need to avoid household time on Saturday.

A few of the brand-new property innovations are making the daily tasks of the profession much easier and quicker. Real estate professionals make, usually, 25 percent more income than all workers, but there truly is no cap on how much you can make. The stronger your business skills are, and the more you take into the career, the more you'll get out of it.

The sky's the limitation (what does it take to be a real estate agent). Because you're not making an income from an employer, your earnings are based upon your deals every month. If you have a sluggish month, your takeaway is less. The task is based on commission so if you're not selling a home you do not instantly get a paycheck.

If you hang out producing a savings fund prior to you delve into real estate then you won't have an issue with capital in the sluggish durations. When deals select up, you can replenish your savings fund for the next time. Ensure you account for some of the most common real estate agent expenditures while you're budgeting for how much you ought to save.